When to Start Collecting Social Security

The biggest challenge for Americans who are approaching retirement age face is deciding when to start collecting Social Security. The choices are whether to start collecting Social Security earlier and receive smaller payments, or wait to start collecting it later and receive larger payments.

Social Security Statements

The amount of Social Security you are eligible to start collecting depends on how much you’ve paid into it over the course of your working life. The Social Security Administration will send a statement to you every 5 years from ages 25-60, and, after that, 3 months prior to your birthday, that shows your earnings record and future benefits estimate. You may also check your account online through the MY SSA web site.

Calculating Social Security Earnings

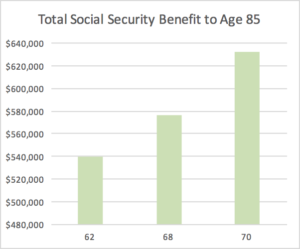

For every year that you collect Social Security payments early costs about 7% of what you could earn by waiting. This is true until you reach 70, when your potential payment maxes out. In other words, every year past age 62 that you wait before collecting Social Security increases your monthly benefit by about 7%.

For every year that you collect Social Security payments early costs about 7% of what you could earn by waiting. This is true until you reach 70, when your potential payment maxes out. In other words, every year past age 62 that you wait before collecting Social Security increases your monthly benefit by about 7%.

Factors to consider

There are several factors to consider when deciding when to start collecting Social Security payments, including:

- You have a short life expectancy. If you don’t expect to live until age 86, currently the life expectancy of the average American, then it might make more sense to start collecting Social Security now. Those in poor health or with chronic health conditions may reasonably decide to take their benefits now. Likewise, if family medical history in certain life threatening diseases may make a similar decision.

- You need the money. If your savings or retirement won’t cover your monthly expenses and you need the benefit to help make ends meet, then it makes sense to take the money as soon as it’s available.

- You don’t trust the system. Many people who believe that the government will lower benefits, cancel the program, or otherwise negatively change the SS program decide to start taking their payments early.

- You want to invest the money yourself. If you’re active and successful in the stock market, real estate, or other investment, and can get an investment return greater than 7%, it makes sense to putting your Social Security payments into an investment account now.

- You’re still working. If you’re still working and collecting Social Security, your payments will be penalized $1 for every $2 you earn over a cutoff (currently about $15,000). It makes sense to hold off on collecting if you’re still working full time.

- You have other assets. If your retirement is well funded via a financial vehicle like a 401K or IRA, there’s no reason to start taking your Social Security benefits early.

The factors you consider when deciding when to start collecting Social Security depend on your situation. Ultimately, if you’re in good health, to potentially maximize the monthly and total benefit, you should decide to start receiving Social Security checks as late into your retirement as possible, but no later than age 70.